Once you’ve been in business for a time, you realize that you’re ready to scale your startup and take operations to the next level. But, your cash flow isn’t enough to move forward as fast as you would like. So, you explore your funding options. One channel that sounds appealing is venture capital (VC), so you start to research your options.

But, once you start comparing VC firms in your area, you get a little confused. And, when you realize that the top VC-invested companies are major players like Facebook, Stripe and WhatsApp, the path starts to look intimidating. There are many questions left unanswered. That’s where this guide comes in.

Here, you’ll gain a better understanding of startup venture capital.

- How VC works for startups

- What venture capitalists look for when investing

- The steps you can take to secure VC for your company

So, if that’s what you’re looking for, read on.

First, What is Startup Venture Capital?

Startup venture capital is a type of private funding that comes from investors called ‘venture capitalists.’ Typically, venture capitalists make a significant financial investment in exchange for equity in a company with growth potential. That’s the short answer.

To further understand this type of funding, we need to look at the who, where, when, and why. Which startups are candidates for VC and where can they find it? At what stage of growth would a founder seek out VC funding and why would it be helpful?

Here’s What Venture Capitalists Look for in a Startup

VC isn’t for every startup. In fact, you must be able to prove that you have the potential to generate outsized growth. So, if you’re in the early stages of business and have limited market traction, this likely isn’t the right type of funding for you.

But, if you have shown significant returns at this point or secured a substantial amount of funding from other sources, you’re ready to learn what venture capitalists look for in a startup before they consider investing.

The companies that venture capitalists invest in typically have the following characteristics:

- Products and services with a competitive edge in a large market

- Strong and proven leadership and internal staff

- A limited number of other investors

- Proof that others are likely to pay for the company

- Conversion in multiple customer segments

VC is considered risky for investors, but gains are typically high. Ultimately, the goal for most venture capitalists is to see a company they invest in have an exit value return of at least 10x the level of their investment within a time period around 3-7 years. These exits usually come through an acquisition but in rare cases could even come in the form of a public offering in the stock market.

If a startup’s products and services don’t have obvious differentiators from competitors in the market, they are in a small niche or cannot grow future revenue at a level much higher than expenses, then this type of funding won’t typically be available.

Circling back to the major players that utilize this funding, you find many companies that received VC early on. Starbucks is an excellent example of a startup that received VC then moved on to be publicly traded and employ hundreds of thousands of workers. Now, they invest in food and retail via Valor Siren Ventures.

Venture capitalists are seasoned and understand what it takes to succeed in big business. So, they’re looking for investments in companies that have the potential to disrupt the markets they compete in.

When is the Right Time to Seek Out VC Funding?

Most companies start out with personal capital or funds from friends and family. And, until they are able to show $4 million in equity investment from an institutional investor, $10 million in revenue or a profit, they likely aren’t able to access most forms of traditional debt funding. Instead, in the early phases, they may rely on family, friends, corporate credit cards, and cash flow to keep operations running.

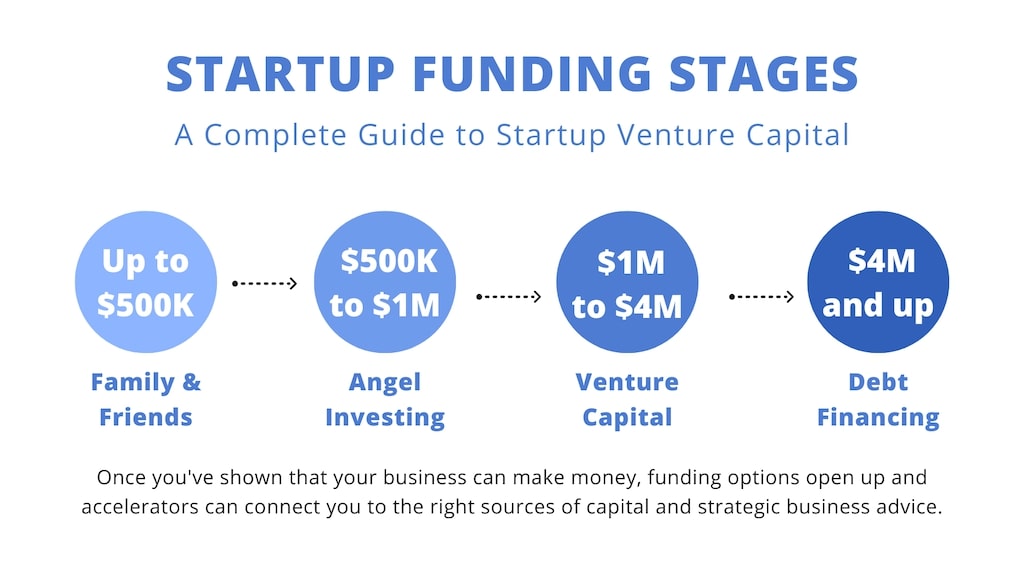

Startup funding stages

Once companies have moved past their friends and family round, they are often candidates for capital from angel investors. Like venture capitalists, angel investors seek equity in a company in exchange for funds. The difference is that angel investors are individuals that disperse their own funds while venture capitalists are members of firms that invest from a pool of funds originating from multiple sources.

So, venture capitalists are typically more rigid, sector specific and invest larger absolute amounts than angel investors. VCs generally won’t consider supporting a startup until they can demonstrate exponential revenue growth or traction in an untapped market. Most venture capital portfolio companies also need to justify a valuation of at least $5 million since these capital providers usually like to lead a deal with a minimum investment of $500k or $1m.

Revenue is not a prerequisite for VC investment, however most companies have a clear path to $1 million in revenue before constructive discussions can commence.

What’s the Catch?

Ok, your business has $1 million in revenue and you now have access to a new surge of funding options that you can use to grow. So, why isn’t every revenue-generating business on the VC train?

Even if your startup meets all of the requirements that venture capitalists look for, you may not want to go this route. You must know that equity in your company comes with a stake in your operations as well. VC firms will ask you to make business decisions that are sometimes out of your control.

So, if generating equity return from growth at an accelerated rate isn’t your number one priority, you may want to evaluate other financial strategies. But if you’re serious about and ready for growth, learn how to obtain VC funding.

Now, How Can You Secure VC for Your Startup?

Unfortunately, you can’t just waltz into a VC firm and ask for money. And, presentations aren’t as simple as they look on Shark Tank. You need to know what will boost your chances of securing capital and specifically what to do.

When you’re ready to obtain funding, what steps should you take?

1. Join a Business Accelerator

One of the best ways to get your foot in the door and your business in front of the right people is to enlist the help of business accelerators. Accelerators can help you find the capital, services, and strategic guidance needed to speed up business growth. And, not only will an accelerator be able to put you in front of venture capitalists, but they can help you determine if this is, in fact, the right type of funding for your situation.

Recommended Reading: Business Incubator vs Business Accelerator: What’s the Difference?

2. Create a Pitch Deck Presentation

There is a certain way to talk to potential investors. And, a pitch deck is what VCs have come to expect. So, next in line of action is to compile your presentation.

A solid pitch deck includes the following sections:

- Key Problem & Solution – What is your startup facing right now that requires funding and how do you plan to overcome the issue?

- Market – What is the market for your company/product/service? This should include demographics and market size.

- Product or Service – What problems does your product or service solve for the end-user and how does it accomplish this?

- “Traction” – What proof do you have that people will pay for your product or service? Can you show that your company is a candidate for future acquisition and/or a transition to public trade in the stock market?

- Leadership & Team – Who are you? Who are the core team members? What qualifies you and your team to see this venture to fruition? Does anyone in your team have prior startup experience or a successful exit in the past?

- Competition – Who are your main competitors and what makes your offering stand out from them?

- Financials – How much revenue have you generated and how much funding have you received thus far?

- Target Funding Amount – How much funding are you trying to raise via VC and what is the valuation of your company?

Keep in mind that you will present your pitch deck to investors who are busy — this means that a concise and visually-appealing but simple presentation is important. You don’t want to bore VC’s with too much information. And, there’s no need to be overly showy.

3. Target the Right Firm to Request Funding

In the end, your goal is to find a VC firm that is likely to understand your vision and share your passion or at least realize the financial potential. If investors have experienced the same problem that you currently face, you will have an upper-hand. So, target a firm that has experience in your industry at the very least.

The best-case scenario is to obtain VC from investors who have worked with the brands that inspire you. They could have experience running relevant companies or investing in similar or adjacent brands. It should go without saying, but if you’re in education technology, don’t seek financing from food retail venture capitalists.

When you think you’ve found the right investors, it’s best to set an appointment using a warm connection in your network and have a message that is catered to the individual you’re reaching out to.

4. Scrutinize Your Term Sheet

Once you’ve successfully pitched for funding, you might be inclined to sign on the dotted line the first time you hear the word “yes.” But, you need to understand all terms before you accept VC funding. You wouldn’t want a loan with an astronomical interest rate and you don’t want to sign control of your company over to anyone without fully understanding the offer.

You will have financial and operational obligations to meet. There will be a corporate governance section that outlines the power that founders and investors will have over business processes and planning. And, a liquidation and exit section will define who gets paid and in what amount if your company is liquidated. Be diligent, remember that it’s even possible for you to generate a positive exit return and lose equity if you don’t meet the threshold return levels that are negotiated. It might be important that you work with an experienced attorney to fully understand all of the terms agreed on before you accept them. And, getting multiple interested VCs may help you leverage terms during this negotiation process.

Final Thoughts

If your startup is in a stage where you can show significant potential for ROI and you’re ready to take your operations to the next level, venture capital can be a powerful catalyst. At Workbox, we provide founders with the tools to have constructive conversations with VC and angel investors and then facilitate one-to-one meetings with the best investors to help take their businesses to the next stage of growth.

We also provide access to a deep network of strategic services that specialize in areas such as legal, HR, recruitment, finance, and tech support to help make sure you are successful both before and after an institutional equity raise. To learn more, schedule a tour today.